The initial public offer (IPO) of HDFC Asset Management Co. Ltd,India’s second largest fund house with assets of ₹3.06 trillion, is open from 25-27 July. The issue price on a ₹5 face value share is expected to be ₹1,095-1,100, to be decided through the book-building route. In November 2017, Reliance Nippon Life Asset Management Co. Ltd, the country’s fourth largest fund house with assets of ₹2.40 trillion, got listed. Its listing price was ₹294 on BSE Ltd; its shares closed at ₹218.45 on 23 July 2018. Industry insiders says a few other large asset managers may also get listed eventually.

Should you follow the same principles in picking up shares of a fund house as you do when you invest in its schemes? The answer is no. Picking a mutual fund scheme is very different from picking equity shares of its asset manager. Here’s what will determine your AMC’s run on the stock markets.

When XXL is better than S

While picking up a scheme from a small-sized fund house is fine, the same may not be true if you want to buy a share of a small- or medium-sized fund house. For the scheme from a small fund house to do well, its fund manager has to be skilled in stock selection, the size of the fund house has little to do with the return you will see. But when you buy a stock of an MF company, size matters. The income and, therefore, profit of a fund house depends on how big it is because MFs charge investors a certain percentage of the assets under management. The larger the pie, the larger is the fund house income.

“Fund performance depends on market; AMCs have no control over market. The mutual funds business is a pure assets gathering game. Unlike a manufacturing company that can reduce its price, offer discounts, new products and so on, a fund house does not do all of that. It has to gather assets if it wants to make money,” said Deepak Chhabria, CEO and director, Axiom Financial Services Ltd, a Bengaluru-based distributor of financial products.

Can HDFC AMC grow?

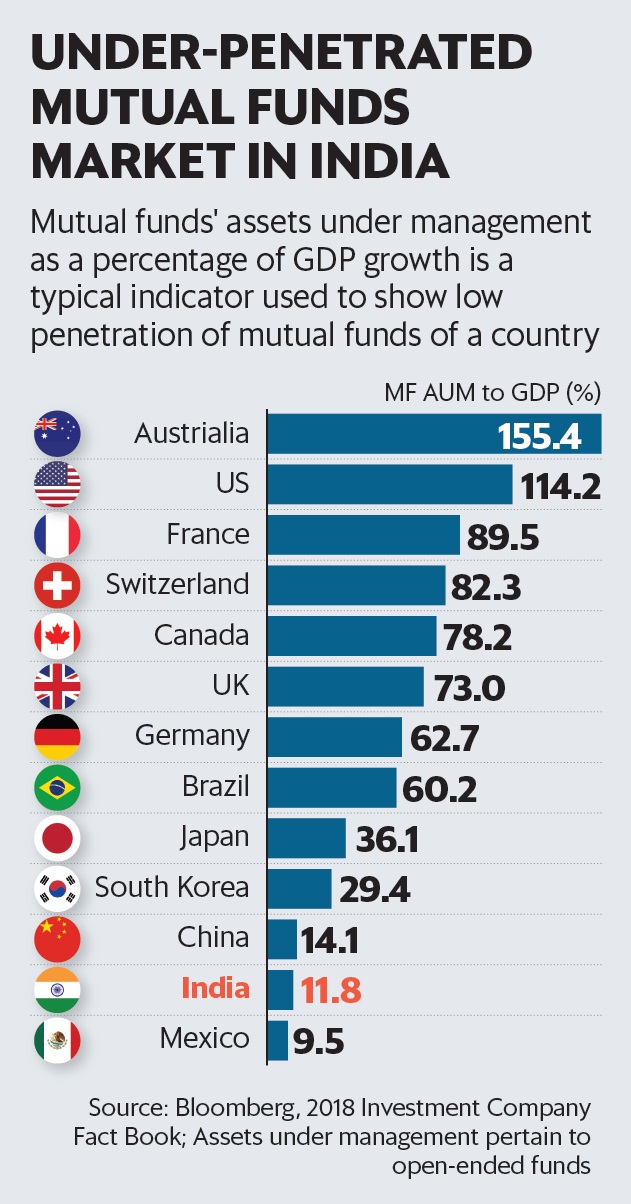

Although MFs have been in India since 1987 and private sector fund houses entered the space in 1993, they haven’t yet penetrated in the hinterlands of India . But there is room ahead for expansion. “The ‘financialisation’ of savings is going to be the biggest driving factor, fuelling the potential growth of the MF industry in India. With MF-to-GDP ratio in the country at just about 10% compared to about 50% in the UK and about 90% in the US, the opportunity for growth is large,” said Nithin Sasikumar, co-founder and head-research, Investography Ltd, a wealth management firm.

Investors should look out for the ratio of equity assets to total assets. Higher expense ratios (the fees that fund houses collect) in equity funds of up to 2.5% translate into higher profits. Brands like HDFC AMC score; they were able to grow assets even during market slowdown during 2008-2012.

What if expense ratios fall?

Just because a fund house is growing its assets doesn’t guarantee more income. If expense ratios go down, it can hurt revenue. This is the biggest threat for an AMC.

In February, Sebi tweaked the definition of a small town from ‘Beyond 15’ or B15 town to Beyond 30 or B30 town. In 2012, Sebi allowed fund houses to incentivise sales from B15 towns by offering distributors there extra commission of 0.30%, and also barred closed-end funds and those that do not charge exit loads from charging the extra 0.20% fees they used to collect.

Can expenses come down further? Milind Barve, managing director, HDFC AMC, told Mint, on the sidelines of the press conference announcing the IPO, that he “does not expect expense ratios to come down in near future, after the February cuts”. But no one can tell the future. “There is a fair chance of expense ratios to come down further over the next few years. As markets get mature, it would get tougher—though not impossible—for fund managers to outperform the benchmark index. They will find it difficult to justify higher expense ratios,” said Shyam Sekhar, chief ideator and founder of iThought, a Chennai-based investment advisory firm.

Then, there is competition. When Radhika Gupta joined Edelweiss Asset Management Co. Ltd as CEO, she took few key measures to boost the wearying fund house. Among them was cutting down the expense ratio of its large-cap fund, Edelweiss Large Cap Fund, to 1.3%. “When large-cap funds don’t offer significant alpha, what’s the point in charging so much fees? Today, our large-cap fund is one of the cheapest large-cap funds around,” she said.

There is also significant competition from PMS service providers. HNIs have shown preference for these products due to the higher alpha that they have generated and the concentrated portfolio that is created with less regulation. Many MF industry veterans have moved out of the industry and set up shops offering PMS solutions.

Distributors vs direct plans

Experts believe that fund houses with a large proportion of direct sales have a better brand and bigger pricing power when it comes to fixing commissions for distributors. Industry experts say that fund houses, especially large ones, have increased their focus on direct plans. They have also steadfastly increased their branch network. HDFC AMC Ltd’s red-herring prospectus said it has increased the number of branches to 210 as of 31 March 2018, up from 141 as of 31 March 2014. Barve said the branch network is not to increase direct sales, but “to service more distributors in smaller towns as they enter the MF business”.

Ashish Shah, founder of Wealth First, said, without directly alluding to HDFC AMC Ltd, that increasing branch network usually means that fund houses intend to enhance direct presence. But, he added, that it doesn’t mean it won’t cater to distributors. A higher direct share also means the brand is good—since there are direct investors without any push—and that too gives better pricing power to the fund house.

While today direct sales in equity funds of top 10 fund houses are just 14% on average, watch this number. Larger direct sales leave meat on the bones for the AMC, while distributors can eat up the bone too.

What should you do

These are still early days and more AMCs may get listed. However, from the way the mutual funds conduct their businesses, it makes sense only for large fund houses to get listed. As a mutual fund investor, you should continue to invest in funds. Leave direct stock investing and IPOs to the real experts—other mutual funds.

[“Source-livemint”]