London investors miss out on returns enjoyed by rival stock markets in Frankfurt, Paris, Tokyo and Shanghai

City investors are nursing losses after the FTSE 100 ended the year as one of the worst performers among global stock markets.

Britain’s biggest share index shed almost 5% during a volatile 12 months dominated by the commodities crunch and fears over China’s slowing economy.

It means London investors missed out on the returns enjoyed by their rivals in Frankfurt, Paris, Tokyo and Shanghai.

In a lacklustre New Year’s Eve trading session, the blue-chip index dropped 31 points to finish the year at 6,242. That left it 324 points adrift of the 6,566 point mark where it began the year – a decline of 4.9%.

Connor Campbell, an analyst at the City firm SpreadEx, said it was a “limp, whimpering finish” to the year.

“After a year that began so promisingly the markets are wrapping up 2015 in the limpest way possible, a collective sigh instead of any attempt at New Year’s Eve fireworks,” he said.

Nine months ago, City traders were celebrating as the FTSE broke through the 7,000-point mark for the first time. It reached an all-time closing high of 7103.98 in April.

The index was rocked over the summer, however, as evidence mounted that China’s economy could suffer a “hard landing”. It shed a tenth of its value in four dramatic days, as the so-called Great Fall of China rocked markets across the globe.

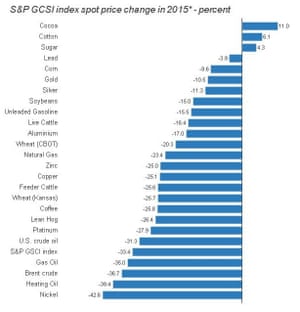

This fuelled a collapse in commodity prices. Crude oil has fallen by almost a third this year, while copper has tumbled by 25%. Gold fell by 10%, posting its third annual fall in a row.

This in turn triggered major slumps in the value of the world’s mining giants, many of whom are listed in London. Anglo American, which produces platinum, copper, nickel and iron ore, plunged by 75% to record lows during 2015.

The commodity trader Glencore also ploughed new depths, losing 69.5% of its value. Rio Tinto dropped by 34%.

While the FTSE lost ground, the German DAX posted a 9.8% gain and France’s CAC index jumped by 8.5%. European indices benefitted from the European Central Bank’s quantitative easing programme, announced in January, which weakened the euro and helped eurozone exporters.

The London stock market also suffered from concern that a rise in US interest rates would derail emerging market economies. That historic hike finally came two weeks ago, starting the process of “normalising” monetary policy and weaning investors off ultra-cheap money.

The prospect of a Federal Reserve rate rise drove the dollar up by around 9% against other currencies this year.

That was welcome news for Japan, where a weak yen should combat deflation and help exports. Japan’s Nikkei rallied by 9% during the year.

Despite August’s slump, China’s Shanghai stock exchange gained 10% during 2015, outperforming the FTSE. It rallied during the autumn, as authorities committed to new measures to prop up share prices.

The US market was more subdued, the Dow Jones ending the year 2.23% down, although the Nasdaq Composite was 5.73% up, with a degree of investor enthusiasm for tech shares not seen since the dotcom boom of 2000.

Jeremy Cook, chief economist at the foreign exchange firm World First, believes Beijing’s ability to stabilise its economy will shape the global outlook in 2016.

“China at the moment is feeling the blowback of years of investment driven growth with industries chock full of unproductive factories, a housing sector with a significant stock overhang and ensuing high debt levels in local government and corporate balance sheets,” he said.

Some analysts believe that the London stock market will struggle to achieve major gains in 2016.

William Hill is offering odds of 7/2 that the FTSE 100 will be over 7,000 points in a year’s time, but only 6/4 that it finishes 2016 between 6,000 and 6,499 points.

“We don’t see a vast amount of movement in the FTSE 100 this year,” said a spokesman.

The City will spend the coming months fretting about whether UK interest rates will rise for the first time since 2007, according to Joshua Mahony, a market analyst at IG.

“There is reason to believe that 2016 will also see sentiment largely driven by the movement of oil prices, their impact upon inflation expectations and the

subsequent monetary policy stance from the Bank of England,” he said.

The weakening oil price has hurt Russia’s currency. On Thursday, the Russian rouble hit fresh record lows, touching 74 roubles to the dollar.

2015 was “a rotten year for emerging markets” generally, said Kit Juckes of the French Bank Société Générale.

“The big losers include the newly floating/sinking Argentine peso, the Brazilian real, the South African rand and the Colombian peso, which are all down by more than 25% against the dollar and are even down against the rouble.”

[Source:-the gurdian]