India is proposing to create a new entity for financing infrastructureNSE 2.95 % that will seek to bolster lower-rated bonds issued by companies in the sector.

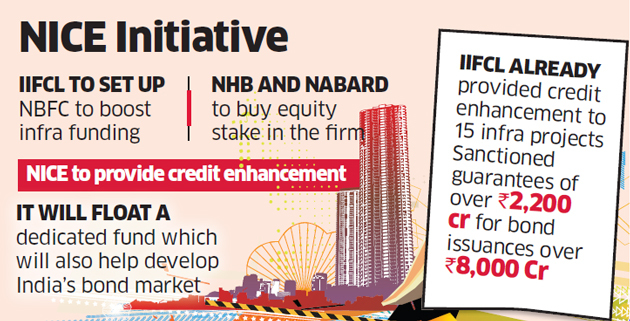

The National Housing Bank (NHB), National Bank for Agriculture and Rural Development (Nabard) and India Infrastructure Finance Company Ltd will be roped in as investors for the proposed entity National Infrastructure Credit Enhancement Ltd or NICE.

” We have had some discussions regarding these two institutions picking up 5-10% stake in the proposed non-banking financial company (NBFC),” a finance ministry official told ET. IIFCL will hold 22.5% stake in the entity.

The government had earlier tried to get Life Insurance Corporation to anchor the NBFC, but the state-owned insurer was not keen, prompting a lookout for other investors.

As per the latest Economic Survey, India needs $4.5 trillion to be spent on infrastructure developments over the next 25 years of which it will be able to garner $3.9 trillion.

While bank credit towards infrastructure sector has increased in the last one year, it had plunged to Rs 8.90 lakh crore in March 2018 from Rs 9.64 lakh crore as of March 2016.

“There is also an asset liability mismatch for banks as infra loans are for longer tenure,” the above quoted official added.

NICE will set up a dedicated fund to attract infrastructure investments by insurance and pension funds to provide credit enhancement to infrastructure companies.

It will provide guarantee to lower-rated bonds issued by infrastructure companies and bolster their ratings. More than 85% of corporate bond issuance in India is by borrowers with ratings of ‘A’ and above, according to recent RBI data.

Credit enhancement helps issuing companies improve their bond ratings, as bond payment is guaranteed to a certain limit. The issuer also gets access to markets at cheaper rates than borrowing from banks. “Credit enhancement, as a product, is most desirable to promote the bond market in India,” said former IIFCL chief executive Pradeep Kumar, adding that the spread available for all the stakeholders to share among them is very small, which doesn’t make this product attractive enough.

The government had announced that LIC will set up a Rs 500 crore credit enhancement in the 2016-17 budget but it could never take off because of regulatory issues. The government then roped in IIFCL to anchor the fund, and other institutions such as State Bank of India, Power Finance Corp and the multilateral institution Asian Infrastructure Investment Bank (AIIB). But the certificate of registration as an NBFC-CE from the Reserve Bank is still to come, the official said. Also, guidelines for such NBFCs are yet to be firmed up.

Some other participants the government was eyeing lost interest given that the return on equity was low. “National Infrastructure Investment Fund (NIIF) showed its reluctance citing the returns are measly at around 5%,” he added.

[“source=economictimes.indiatimes”]