Mumbai: The highlights of AU Small Finance Bank Ltd’s fourth quarter (Q4) results would indicate that the lender deserves the lofty valuations it has currently. After all, net profit grew at an impressive 42% in Q4, backed by a healthy 35% growth in net interest income.

What’s more, growth in assets under management was 51%, and the fact that deposit growth continues to impress provides comfort. Deposits more than doubled, which means the lender is not struggling on the liability side, which was a concern for some small finance banks.

Since its birth as a lender of small loans in April 2017, AU Small Finance Bank has grown faster than its peers. Part of the reason was, of course, a low base to start with.

But fresh disbursements grew just 20% in Q4, a far cry from more than 50% growth seen in previous quarters.

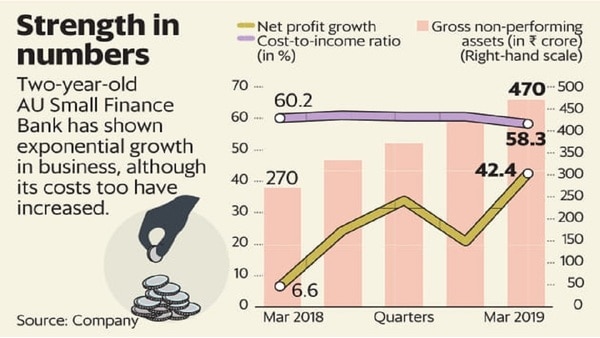

Besides, look closely and it would become obvious that loan growth hasn’t come from healthy quarters alone. The bank’s bad loan stock has surged 74% to ₹470 crore in the March quarter, from ₹270 crore in the corresponding quarter of FY18. Bad loan ratios are optically better than a year ago, simply because of the scorching loan growth.

Also, fee income growth has moderated, which is a concern. Fee income is critical for small finance banks to scale up, given that regulatory rules limit the size of loans disbursed by them. Yet another worry is that the lender hasn’t been able to keep a lid on its operating expenses, which rose 12%.

It is no wonder, then, that some analysts are wary of the valuations the lender enjoys.

“Current valuations of 27 times FY21 forward EPS (earnings per share) are demanding, leaving little room for disappointment,” notes Nomura Financial Advisory and Securities India Pvt. Ltd. The firm’s analysts have a neutral rating on the stock.

Granted, the growth potential of AU Small Finance Bank is hard to ignore as there is a vast untapped loan market that microlenders cater to. That said, lending to small borrowers has its own risks and these are not adequately priced in the stock.

AU Small Finance Bank has gained 5.8% in the last two months and trades at a valuation of 3.8 times estimated book value of FY21. Large full-service lenders such as HDFC Bank Ltd and ICICI Bank Ltd trade at lower multiples.